Maybank introduces two new designs for Family & Friends Card

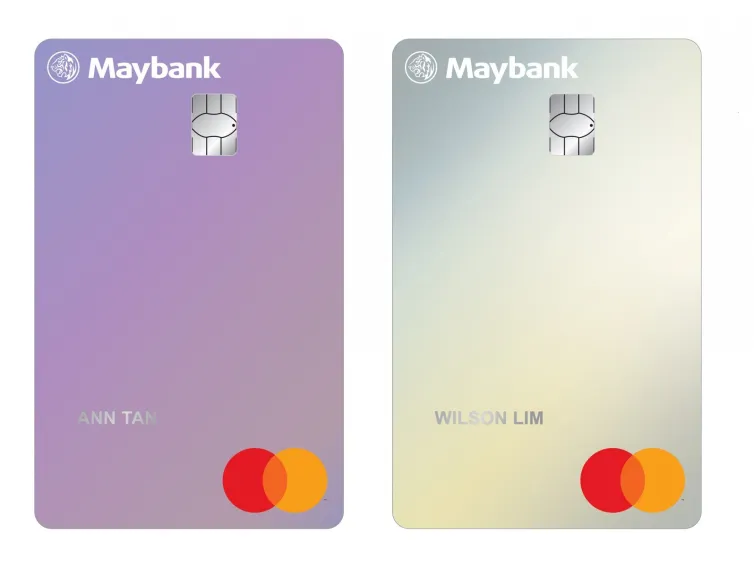

New customers may choose between the original black, as well as the new lilac and silver designs.

Maybank Singapore has refreshed the Maybank Family & Friends Card, adding two new card designs as part of its brand campaign aiming to enhance customer experience.

The physical card—touted as the first to offer card members the freedom to customise cash back categories—is also now available in lilac and silver colors. New card members may choose any from the three designs that most appeals to them, according to Maybank.

This product refresh is in line with Maybank's new brand campaign of #ForYou, to enhance its customer experience.

Card members may customise and choose between five out of eight cashback categories, to enjoy 8% cashback with just a minimum spend of S$800 monthly: groceries, dining, transportation, data communication and online TV streaming, retail and pets, entertainment, online fashion, as well as pharmacy and wellness.

Each category has a monthly cashback cap of S$25, therefore the total possible cashback amount to be earned is S$125. This is one of the highest cash back amounts in the market, according to Maybank Singapore.

In the near future, there are plans to roll out more card designs and let card members have the freedom to donate their cashback to a charity of their choice, the bank shared in a press release.

Advertise

Advertise