Singapore banks ace corporate customer satisfaction survey

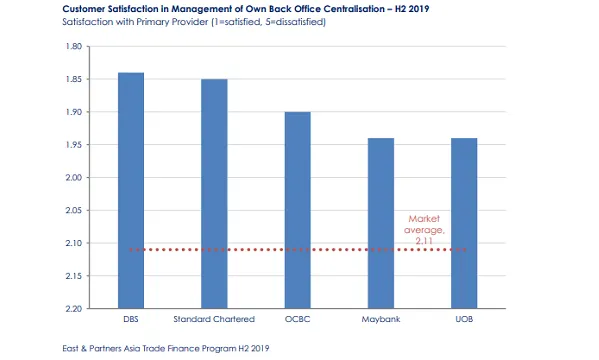

DBS retained the crown in terms of back office centralisation.

Corporate clients in Asia gave top marks to the way banks in Singapore managed their back office centralisation, according to a survey from East & Partners.

DBS pulled ahead of the pack in terms of customer satisfaction followed by Standard Chartered and OCBC. Maybank and UOB round out the top five which all rank above the market average of 2.11.

An earlier survey from East and Partners hailed UOB as the regional leader for liquidity management solutions followed by Standard Chartered and OCBC.

Also read: OCBC develops paper-lite trade finane platform to combat forgers

In terms of pricing competitiveness, Bank of China holds the top spot in terms of corporate customer satisfaction, followed by Bank of India, Maybank, UOB and ICBC.

Banks are seizing trade finance opportunities in the region amidst the prolonged US-China trade war which highlighted the region’s growing supply chain connectivity with China.

“The trade row has sparked renewed corporate interest in having a trade account officer who can demonstrate geographical markets expertise. We see that businesses are starting to look for alternative markets, rerouting their supply chains as a long-term solution,” said Sangiita Yoong, East and Partners Asia Business Head.

The bi-annual research looks at demand for trade finance products and relationships from the top 1,000 institutions across ten major markets in Asia including China, Hong Kong, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand and is based on direct interviews with 942 chief financial officers (CFOs) and corporate treasurers.

Advertise

Advertise