Chart of the Week: Which ASEAN country has the largest branch network?

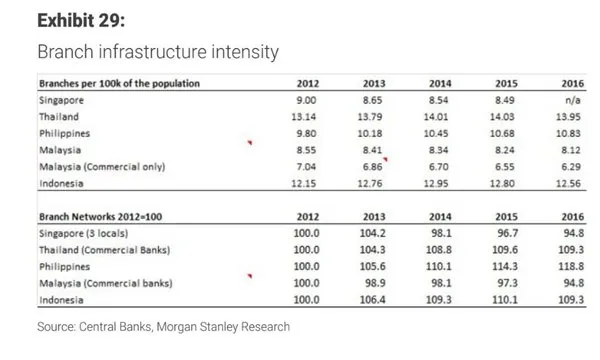

Thailand and Indonesia are the branch-heavy countries.

Thailand has emerged as the ASEAN country with the most intensive bank branch infrastructure with around 13.95 branches per 100,000 of the population in 2016, according to a report from Morgan Stanley, followed by Indonesia at 12.56.

Such high levels of physical infrastructure represent a massive potential for cost savings as banks across the world shun the brick-and-mortar model in favour of branch-lite businesses operating in mobile and web. In fact, Morgan Stanley entertains the possiblity of branch numbers to fall in both countries over the coming years as they migrate their services online.

Also read: Which banks are launching virtual branches in Asia?

The Philippines follows at third place in the scope of its phycial branch network but unlike Thailand and Indonesia, this number is poised to expand given that the network remains expanding given that branches per head are still c.20% below than the two aforementioned countries.

"We therefore see the scope for some cost savings in Indonesia and Thailand, but not the Philippines. Furthermore, in our view, the relatively low level of urbanisation in these countries will also reduce the speed at which branch networks can be reduced," the report's authors noted.

On the other hand, Singapore and Malaysia are amongst those with the least physical bank branches compared to their ASEAN peers.

Advertise

Advertise