Cash Management

Crédit Agricole CIB names Yang Zhang as head of cash and trade sales for APAC FIs

Crédit Agricole CIB names Yang Zhang as head of cash and trade sales for APAC FIs

She will oversee business development and origination of cash management.

UnionBank rolls out payroll account opening solution

Employees can open accounts by scanning a QR code.

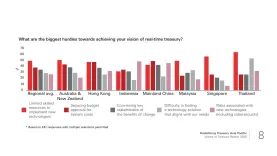

What do corporate treasuries need from banks today?

The majority want a simple, real-time dashboard but may not have the budget or skills.

Ant International to use UBS’ blockchain platform for global treasury operations

The two companies will also explore joint innovations in tokenised deposits.

Banks see sharp drop in cheque use ahead of 2027 phaseout

More people are using e-payment solutions such as PayNow and FAST.

SPD Bank Shanghai, XTransfer team up to help Chinese SMEs expand overseas

They aim to provide “safer, more efficient, more convenient” global collection and cash management services.

SMBC names Sridhar Srinivasan as APAC transaction banking COO

He will be based in Singapore.

CZBank Shanghai, XTransfer ink agreement for cross-border finance

The two will jointly offer cash management services to Chinese foreign trade enterprises.

Airwallex acquires OpenPay, to compete directly with Stripe Billing

Billing capabilities will be rolled out by Q4, Airwallex said.

StanChart, Ant Int’l introduces AI powered treasury and FX solution

It aims to lower FX costs and enhance risk management for Ant Int’l and its clients.

How is tokenisation reshaping cash management solutions?

HSBC and Citi allow 24/7 money transfers using the tech.

Citi expands tokenisation, real-time tools for corporate treasuries

Its suite of digital services optimises cash positioning and cuts operational friction.

Cross-border B2B payments to reach 18.3 billion in 2030

Stablecoins unlock massive potential but need significant infrastructure to be built.

MUFG eyes enhancing intra-Asia flows, sustainability, O&D in FY2025

They are looking into AI as a means to adopt more sustainable and digital practices.

APAC companies brace for more “ultra long payment delays” in 2025

Over 57% of 2,400 companies surveyed expect a deterioration in late payments.

OCBC, Ant Int’t to deliver embedded financial services to Indonesian SMEs

They believe that it will benefit thousands of small businesses.

Companies seek real-time liquidity management to avert cash-flow crisis

There is increased corporate demand for liquidity and risk coverage, says HSBC.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership