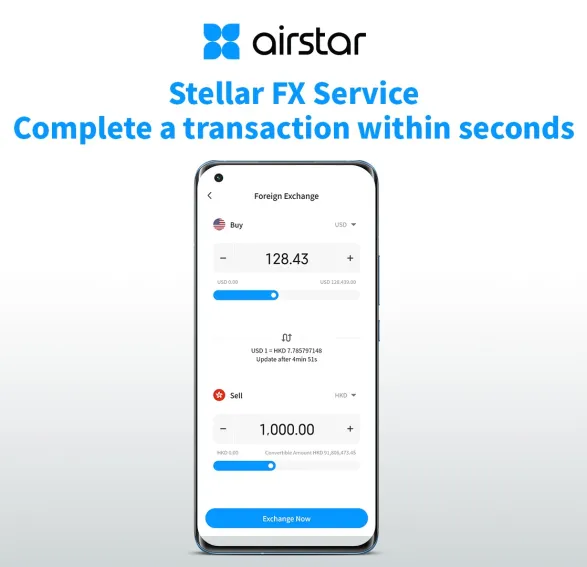

Airstar Bank launches 24-hour FX trading service

Customers who complete FX transactions worth HK$50,000 in total until 31 May will receive an HK$100 rebate.

Airstar Bank, one of Hong Kong’s eight virtual-only banks, has launched its foreign exchange service that includes a 24-hour FX trading, the first for a virtual-only lender in the city.

Customers can view real time exchange rates to track the latest market movements in the bank’s app, and its 24-hour instant trading capability enables clients to immediate trade without being restricted by the working hours of traditional banks, Airstar Bank said in a press release.

Customers can also utilize the funds straight away after transactions and avoid missing out due to delayed trading and seize every potential FX investment opportunity.

The FX service currently supports three currencies, the Hong Kong Dollar, US Dollar, and Chinese Yuan, in competitive rates. As of 9AM 29 April 2021, their USD and CNY exchange rates are lower than the average rate offered by 4 major traditional banks in Hong Kong.

Customers who complete FX transactions in the Airstar Bank mobile app from 29 April to 31 May 2021 will also receive a cumulative amount of at least HK$50,000 (or equivalent) will be eligible for an extra cash rebate of HK$100.

Advertise

Advertise