In Focus

Financial services M&A deal value rise 40% on improved bank profitability

Financial services M&A deal value rise 40% on improved bank profitability

Postal Savings Bank of China’s $18.1b deal with China Mobile is the year’s top deal.

20 hours ago

Indian banks’ deposits and loans log double digit growth on sustained demand

Banks continued to see demand for auto loans and MSME loans.

21 hours ago

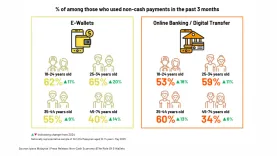

E-wallet use jumps to 65% amongst Malaysia’s 25- to 34-year-olds

Older users logged a 14% rise year on year but still trail younger groups on this method.

21 hours ago

How can Asia-Pacific fintechs survive this year’s funding slowdown?

Hong Kong could emerge as a bright spot.

1 day ago

Chinese banks slash USD bond exposure to 85%

Banks are increasing bond investments in the Euro and likely the AUD, said BofA.

1 day ago

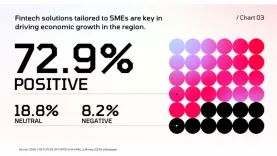

Fintech expands SME credit as 72.9% see growth impact

SMEs make up over 90% of businesses across Asia yet face constrained traditional financing.

1 day ago

Chinese banks miss Hong Kong stablecoin opportunities as rules tighten

China is likely to push the e-CNY as it extends stablecoin restrictions to offshore.

2 days ago

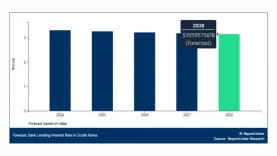

South Korea lending rate to fall to 3.16% by 2028

Borrowing costs will extend their downward trend after a 21% drop in 2023.

2 days ago

Japanese banks face bond yield shocks as yields hit 2.23%

Megabanks should be able to handle the near-term losses, said Fitch.

3 days ago

How digital payments are forcing QSRs to rebuild checkout and staffing

They're redesigning counters and drive-thrus for QR codes and e-wallets.

3 days ago

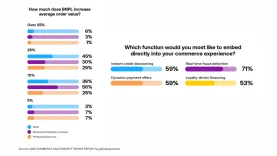

BNPL drives embedded finance as 51% report 25% revenue lift

40% said average order value rose 25% or more in the same survey

3 days ago

APAC fintech exits hit $8.8b in H2 2025 as Hong Kong IPOs rebound

In contrast, IPO activity in Australia was “dry”, said KPMG.

6 days ago

APAC fintech funding slumps 52% as VC investment craters

Total fintech funding reached $19.4b across 1,675 deals in 2022 before sliding.

6 days ago

How will mergers and crypto regulation reshape APAC fintech investment in H1?

Chinese fintechs will embrace "dual-market routes" to grow overseas.

APAC fintech deals drop to $9.3b in 2025 as private equity hits record low

Venture capital investment for fintechs in the region also fell to its lowest in a decade.

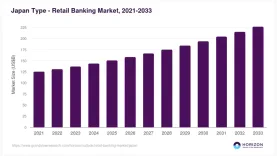

Japan retail banking to hit $227b by 2033

Market revenue stood at $143.7b in 2024 with 5.2% annual growth projected.

Indonesia’s Islamic loans to grow 10% but banks capped at 8% market share

Bank Syariah Indonesia (Persero) is likely to remain dominant.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership