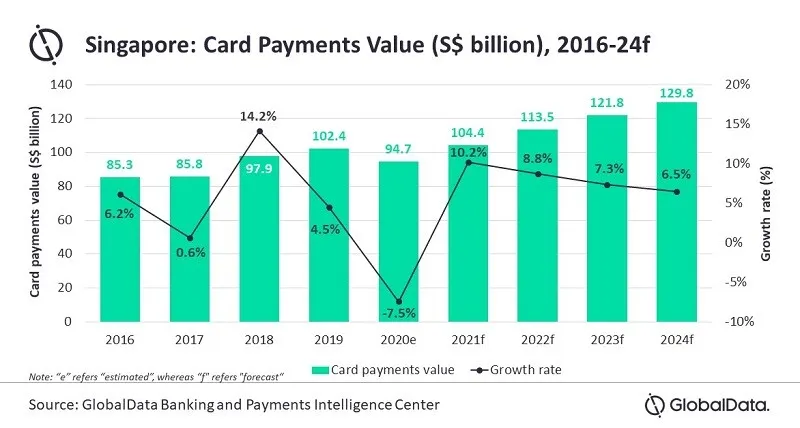

Chart of the Week: Singapore card payments to rebound 10.2% in 2021

Card payments are expected to reach $96.5b in three years’ time.

Card payments in Singapore are set to rebound and grow by 10.2% in 2021 amidst improving economic conditions, according to GlobalData.

The data and analytics company forecasts that the value of card payments will grow at a compound annual growth rate (CAGR) of 8.2% between 2020-2024 and will reach $96.5b (S$129.8b) between these years.

The projected growth considered the reopening of businesses, easing of travel restrictions, and ongoing COVID-19 vaccination programme in Singapore.

To contain the COVID-19, Singapore began its vaccination campaign in December 2020 with an aim to cover the entire population by the third quarter of 2021. This, along with the roll out of stimulus package worth US$81.8bn (equivalent to 24.8% of country’s GDP), has set the stage for economic recovery.

Whilst card payments in the country have been on a sustained growth during the last few years, the growth was hampered in 2020 due to COVID-19 pandemic. The economic downturn affected consumers’ buying capacity and subsequently affected payments market, noted Kartik Challa, payments senior analyst at GlobalData.

The country’s developed payments market provides strong support for its recovery.

“Singapore has a developed card payment market with a strong payment infrastructure and high consumer preference for electronic payments. Whilst the COVID-19 pandemic and the subsequent economic downturn have impacted card payments in the last one year, government support and resumption of business activities are expected to bring it back on growth trajectory over the next couple of years,” Challa said.

Whilst card payment was affected at the height of the pandemic, the loss was partially offset by the shift away from cash and towards contactless cards.

Singapore has a developed contactless card network with majority of consumers having contactless cards, noted GlobalData. Contactless is increasingly becoming the mainstream payment method in the country, accepted by everyone from large supermarkets to small retailers, it added.

Advertise

Advertise