Chart of the Week: What's dragging the growth of Islamic banks in ASEAN?

Malaysia and Indonesia are still trailing behind their GCC peers.

Islamic banks in Malaysia and Indonesia still have a long way to go before they can catch up to their peers from the Gulf Cooperation Council (GCC) markets as their limited capital positions hinders their otherwise positive growth prospects, according to a report from Moody’s Investors Service.

The capital gap between conventional banks versus Islamic lenders is noticeably much larger in Indonesia than Malaysia despite accounting for a significant share of total banking assets.

“Small balance sheets are constraining Islamic banks’ ability to provide large financing for corporates or projects,” the firm said in a report.

Also read: Can Islamic fintech gain momentum in Malaysia?

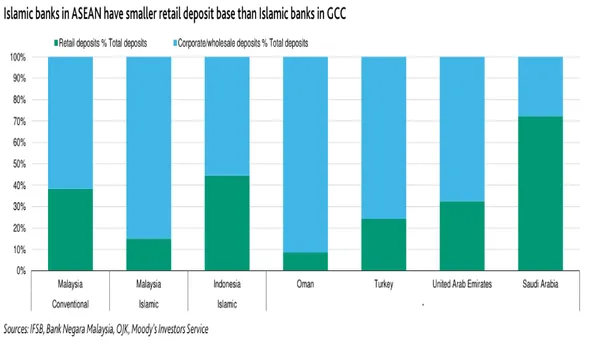

Islamic banks in the region also have smaller retail deposit bases than their conventional peers and Islamic banks in the GCC, which could prove a weakness as they rely too heavily on large corporate deposits. Such deposits are less stable than retail deposits and could weigh in on liquidity coverage ratios under Basel III rules.

“Resolving these limitations will require significant investment, which banks will commit to only if governments are willing to support Islamic banking growth,” added Moody’s.

Malaysia targets to boost the share of Islamic banking assets in total banking assets to 40% by 2020 from 32% as of August 2018 whilst Indonesia is similarly seeking to increase the proportion from 6% in July 2018 to 15% by 2023.

Malaysia is fast leading the way for Islamic financing in the region on the back of heightened regulatory initiatives to boost the attractiveness of the sector including the introduction of the value-based intermediation (VBI) framework and the launch of the first bank-intermediated online platform for shariah financing and investment in 2016.

“VBI adoption will create opportunities for banks to venture into new business segments such as social financing, although this will introduce new risks that require prudent risk management, underwriting standards and governance,” added Moody’s.

Advertise

Advertise