Lending & Credit

APAC developing markets slated to see lower margins in 2026

APAC developing markets slated to see lower margins in 2026

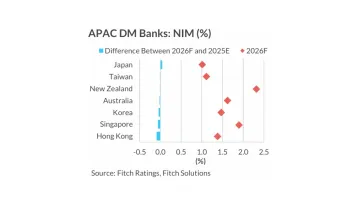

Except for Japanese banks, which could see NIMs rise faster if monetary tightening is more aggressive than expected.

Mortgage competition between Aussie homeowners and investors heats up

First-time homeowners increasingly need to take on more debt to afford a house.

Which suburb in Australia leads in mortgage arrears?

Victoria and New South Wales are the only states represented in the highest-arrears list.

Weak household demand causes 82.9% drop in new Chinese bank loans

This was blamed on weak household loan demand, particularly short-term loans.

Indonesian banks, VinFast ink MOU to make EV ownership more accessible

They will develop attractive loan programs and develop faster credit approval processes.

Business loans in Thailand set to expand in Q4: survey

Lenders are expected to be more cautious of small SME borrowers, however.

UnionBank offers 0% installment plans in Ikea for credit card holders

For a minimum spend, cardholders can avail a 0% installment plan for 3 months.

Aussie mortgage holders and renters lead in unpaid card debt: survey

Mortgage payers owe A$1,342 on average, compared to homeowners owing A$787.

Australians pull back on spending to afford a home loan: survey

Despite this, 1 in 3 Australians believe that they will never afford their own home.

Malaysian banks’ sector earnings on track for growth in 2025

Loan growth was stable in September, although household loan growth was slightly slower.

Philippine banks to maintain lending standards in Q4 2025

1 in 10 banks will tighten lending standards for business and household loans.

India’s digital NBFCs poised for strong loan growth through 2030

Rising digital adoption and a supportive regulatory framework will push growth.

Philippine central bank expands relief measures for banks, borrowers after calamities

Banks will have access to relief measures during a specified period.

Thai banks’ focus on asset quality and ‘clean’ loan books in 2026

The banks are expected to report a loan contraction in 2025 compared to last year.

Westpac unit RAMS fined A$20m for compliance failures

RAMS failed to supervise its reps to ensure compliance with credit law, amongst others.

Philippine-based Asialink secures $75m loan from Standard Chartered

The $75m is set to provide fresh capital to MSMEs.

India’s bank lending expands as GST cuts spur credit growth

As of 3 October 2025, total bank credit rose 11.4% year-on-year.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership