OCBC Bank

OCBC Bank is the longest established Singapore bank, formed in 1932 from the merger of three local banks, the oldest of which was founded in 1912.

See below for the Latest OCBC Bank News, Analysis, Profit Results, Share Price Information, and Commentary.

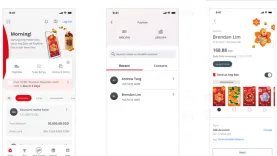

OCBC enables Weixin Pay QR payments via bank app

OCBC enables Weixin Pay QR payments via bank app

Customers will see rates in real-time before making a transaction.

6 days ago

UOB set for growth as DBS, OCBC earnings hold steady: report

The sector benefited from dividend potential and provision write-backs.

E-ang bao use jumps nearly 50% in 2025 as seniors ditch red packets: OCBC

Nearly 8 in 10 seniors were first-time e-ang bao senders, OCBC said.

OCBC opens client stocks to institutional borrowers via Citi platform

The securities lending market generated $1.2b of revenue in December 2025 alone.

Singapore bank wealth fees surge 44% to defy NIM squeeze

Overall fee income is expected to expand at a double-digit rate of 31% this quarter.

OCBC sets up securities financing unit to mobilise idle assets

Customers have the chance to earn fee income from lending out their idle securities.

Bank of Singapore appoints OCBC veteran as global CFO

Collins Chin worked at OCBC for over 16 years before taking on this new role.

Three Singapore banks pull $3.0b in net retail inflows

DBS Group Holdings was the largest recipient of net retail inflows.

Singapore big three banks to sustain strong dividends in 2026: report

Wealth management inflows and activities are expected to be robust.

This week in finance: TenPay Global CEO on interoperable payments; tap-to-pay service roll-outs

OCBC and Vietnam separately strengthen their QR payment ties with China.

This week in finance: CIMB Singapore's new card for sole proprietors; banks' real estate woes; in-app chat services heat up

GoTyme Bank is now compatible with Google Pay.

OCBC rolls out in-app calls for retail customers

In-app calls will not incur International Direct Dialling (IDD) charges.

OCBC adds 8 SEA e-wallets in digital app

Customers in Singapore can now directly transfer money to 10 e-wallets.

Singapore banks to see NIM compression and management fee surge in Q3: UOBKayHian

Uncertainties cause the trends, the brokerage firm said.

Singapore banks show weak brand-experience alignment in 2025

Citibank and DBS were the only banks to achieve high rankings.

Singapore banks face softer earnings as NIMs stay under pressure

DBS also noted growing focus on Singapore banks’ Hong Kong exposures.

OCBC to provide social loans to 10,000 women entrepreneurs by 2030

It has supported over 2,000 women-owned SMEs as of June 2025.

Advertise

Advertise

Commentary

Asia’s banks hold the mandate to innovate. Now they must earn it.

Why Asia's banks are rebuilding their credit infrastructure in 2026

Banks retreat, private credit advances: Asia Pacific’s quiet lending revolution

Human Sparsity Blockchain: A citizen-validated ledger for digital finance supervision

Will stablecoins disrupt the banking business?

Digital transformation starts with leadership